What Is A Multifamily Syndication?

How Does A Multifamily Syndication Work?

General Partners

The General Partners are the real estate syndicators. They are essentially the pilots of the plane. They are the Sponsors and Operators of the real estate syndicate, meaning that they do all the heavy lifting for things like:

-

-

- Finding and underwriting the deal

- Securing the financing for the deal

- Negotiating with the seller

- Completing the due diligence

- Finding and educating investors

- Managing the renovations on the property

- Working with the property management team

- Executing on the business plan

- Communicating with the investors

-

Limited Partners

Multifamily Syndication vs. The Stock Market

Stock Market Investing

Multifamily Syndication Investing

Why Invest In A Multifamily Syndication?

#1 – Cash Flow

#2 – Leverage

#3 – Equity & Appreciation

#4 – Tax Advantages

How Has COVID-19 Affected Multifamily Syndication?

The truth is, we have only seen the tip of the iceberg as far as the full ripple effects of COVID-19.

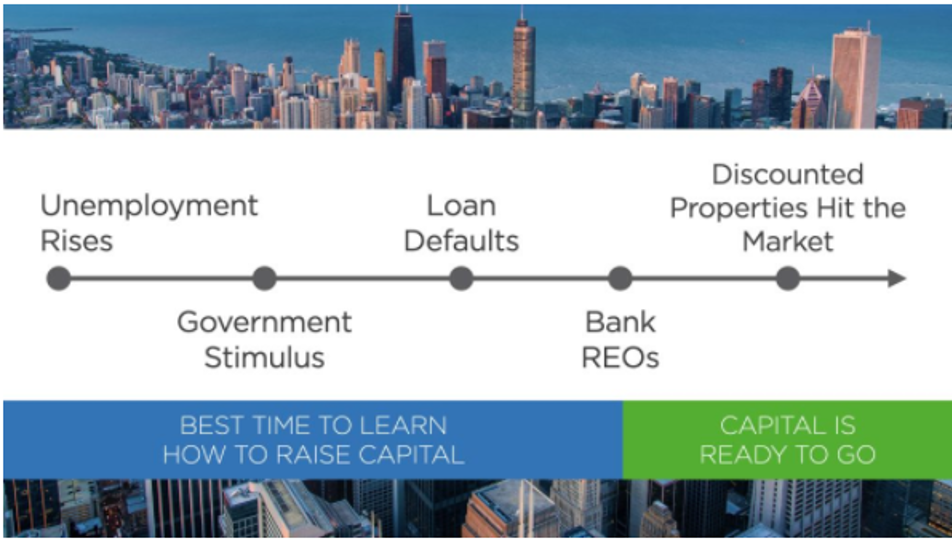

COVID-19 Recession Ripple Effects On Multifamily SyndicationHere are the COVID-19 ripple effects to expect in the coming months and years:

-

-

- Unemployment surges

- Government stimulus

- Stimulus money dries up, leading to loan defaults

- Loan defaults lead to bank REOs

- Foreclosures and other heavily discounted properties hit the market

-

As you can see, we are only in the early phases of this recession. As unemployment has surged, the government stimulus packages have swooped in to the rescue, providing some temporary relief.

In the next phase, as the stimulus money starts to dry up, we’ll likely start to see more and more tenants unable to pay rent.

Eventually, this will lead to more multifamily owners (many of them mom and pop owners or less experienced operators) defaulting on their loans. Once that happens, we’ll then start to see a wave of bank REOs (real estate owned properties).

This is when the best deals will start to flood the market. That means that if you’re a passive investor, now is the best time to educate yourself. And if you’re a syndicator, now is the best time to prepare your investors for what’s to come.

Should You Invest In A Multifamily Syndication In 2020 Or Beyond?

-

- Low breakeven occupancy (Breakeven occupancy refers to how low can the occupancy get while still being able to cover the mortgage and expenses. The lower the better.)

- Make sure each multifamily syndication you invest in has relatively low leverage, high reserves, a strong and experienced General Partnership and property management team, and multiple backup plans

- Low breakeven occupancy (Breakeven occupancy refers to how low can the occupancy get while still being able to cover the mortgage and expenses. The lower the better.)

Ready To Get Started In Real Estate Syndications?

Recent Posts

- 如何通过房地产投资让我的钱每 5-7 年翻一番

- How a Passive Apartment Investor Interprets a Schedule K-1 Tax Report

- How To Become A Mindful Millionaire

- Top Ways To Lower Your Taxes As A Real Estate Investor

- The Biden Tax Plan’s Potential Impact On Real Estate Investors

- Vetting an Apartment Deal Sponsor – 10 Tips from an Insider

- Financial Freedom vs. Financial Independence

- Multifamily Syndication In 2020 And Beyond

- How To Make Active Rental Property Investing More Passive

- How To Ensure You’re Prepared To Seize The Opportunities That Arise

- What Happens To Real Estate In A Recession And When You Should Buy

- Real Estate Syndication Structures And What They Mean For You As A Passive Investor

- 13 Of The Best Real Estate Investing Books To Help You Build Wealth

- Syndication: Common Financial Metrics and Key Terms to Understand

- Start Living A Life By Design, Today And Every Day

- Investor Sentiment Amid The COVID-19 Pandemic

- A Behind-the-Scenes Look At 3 Multifamily Real Estate Syndications

- 5 Things Every New Investor Should Do Before Investing In Their First Real Estate Syndication

- How To Tell Whether You’re An Accredited Investor, And Why It Matters

- How To Quit Your Job Through Investing In Real Estate

- These Are The Key People In A Real Estate Syndication

- 7 Biggest Differences Between REITs And Real Estate Syndications

- You Don’t Have To Be An Accredited Investor To Invest In Real Estate

- Why I Absolutely Love Investing Passively In Real Estate Syndications

- Every Passive Real Estate Investor Should Know About Taxes

- Retirement 2.0: What If You Could Retire Now

- Projected Returns In A Real Estate Syndication

- What To Look For And How To Tell When A Deal Is “Good”

- Define Your Investing Goals

- Beginner’s Guide To Investing In Real Estate

- 7 Steps To Investing In Your First Real Estate Syndication

- Past three months we had settled two large apartment communities

- Attractive tax benefit from Commercial Real Estate syndication

- 5 Reasons Apartment Market in 2019 is Healthy & Top Markets for Investment

- Growth with Downside Protection – 3 “All Weather” Niches to Invest in Now !

- Stuff your portfolio this Holiday Season with Manufactured Home Parks

- Self-Storage – Growing Interest as an Investment Niche

- 6 Apartment Investing Strategies to Minimize Rising Interest Rates

- Syndication: Common Financial Metrics and Key Terms to Understand

- My journey to become a passive investor